Bayesian Optimization under Random and Adversarial Influences

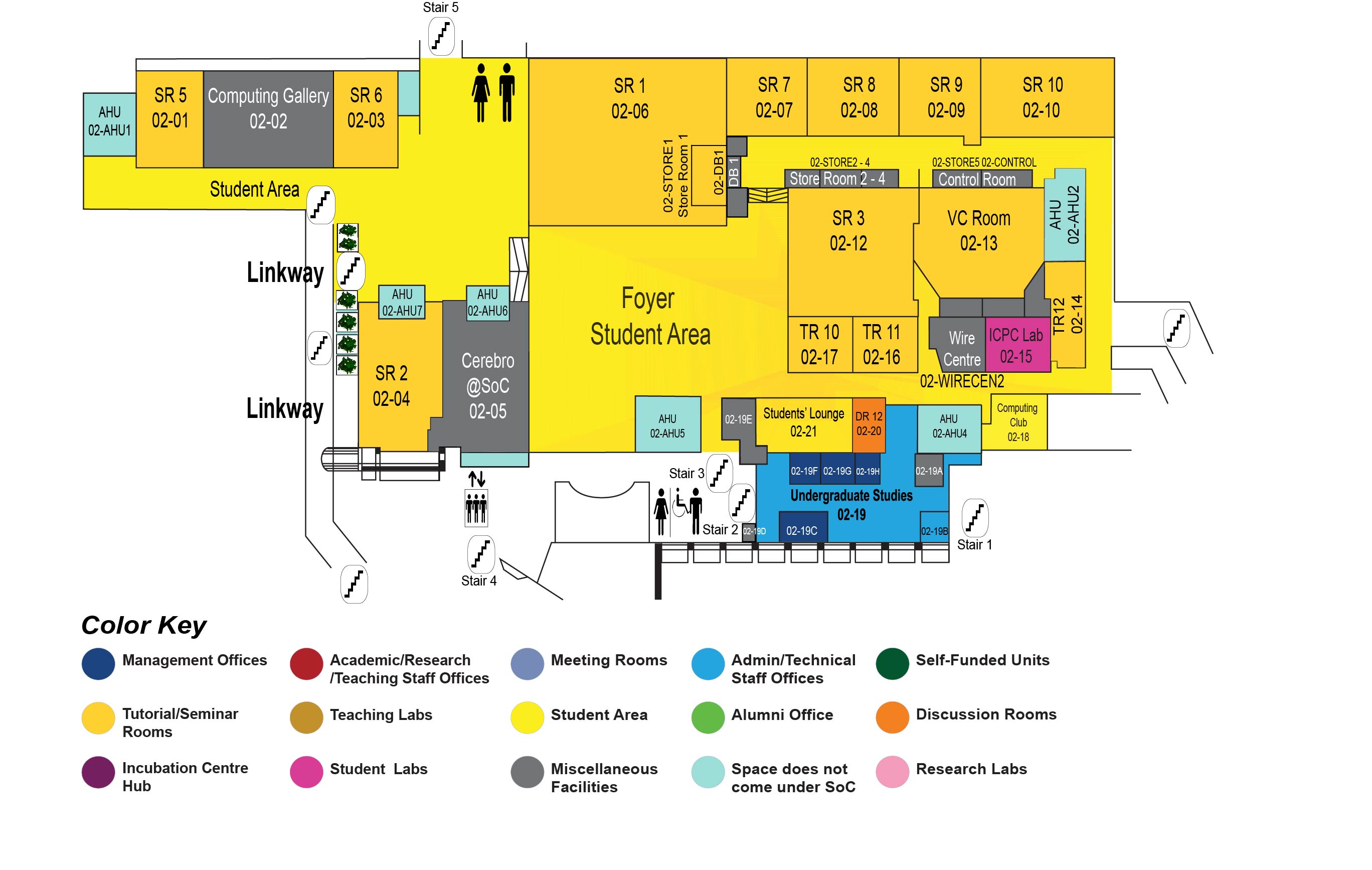

COM1 Level 2

SR6, COM1-02-03

Abstract:

Bayesian optimization (BO) is an established framework for query-efficient derivative-free optimization that has been widely applied to real world problems of significance, including hyperparameter optimization, drug design, and many others. The classic BO formulation assumes that all query variables (inputs to the unknown objective function) are controllable by the learner. However, there are many practical problems in which this assumption fails, and some query variables may be subject to random or adversarial perturbations instead. For instance, a farm seeking to maximize crop yield can control the quantities of nutrients in the soil, but cannot control the amount of sunlight the crops receive in a given period.

This thesis aims to improve the real-world applicability of BO by studying extensions to classic BO designed to handle random or adversarial influences. The first study proposes BO with cost varying variable subsets in which the learner can choose a subset of input variables and specify their values and leave the rest to be randomly sampled, and each chosen subset has a cost. The second study applies BO to the problem of finding Nash equilibria in games with unknown utilities in which subsets of input variables represent the policies of self-interested agents who may deviate to maximize their own utilities. The third study considers distributionally robust BO and leverages techniques from operations research to develop a computationally efficient acquisition that enjoys smaller time complexity as compared to previous work. The fourth study extends distributionally robust BO to a unified framework that includes several other uncertainty objectives such as worst-case sensitivity (and thus notions of risk such as variance, range, and conditional value-at-risk) and mean-risk tradeoffs. In all extended settings, we provide algorithms tailor-made to solve each setting, analyze their theoretical properties with regret bounds, and compare their empirical performance to suitable baselines.