A Learning Framework For Winning Like A Multi-Manager Hedge Fund

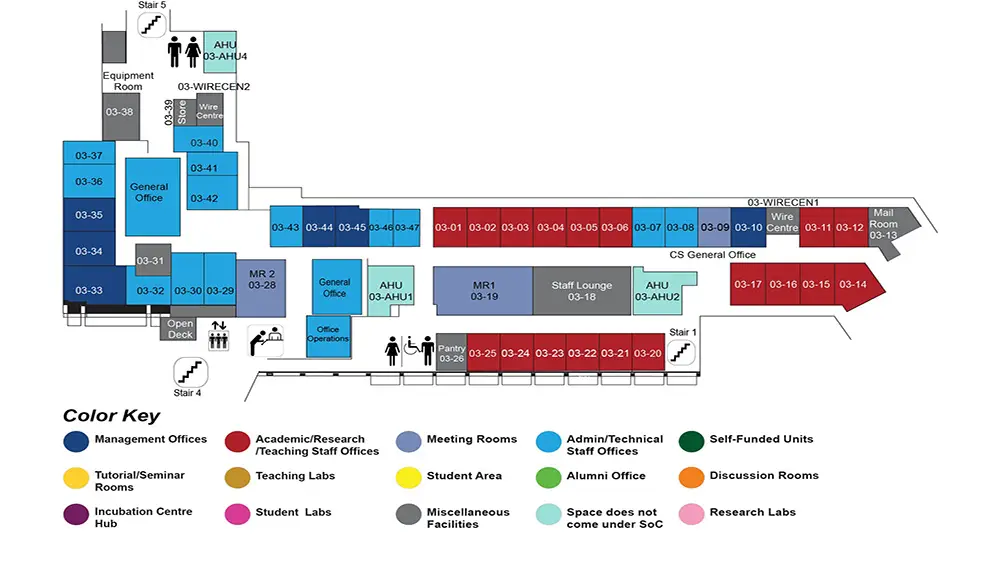

COM1 Level 3

MR1, COM1-03-19

Abstract:

Alphas are predictive models identifying buy and sell signals for stock trading. A set of effective alphas can generate weakly correlated high returns for diversification. Diversified alphas not only ensure diversified investments are buffered from risk but also can be ensembled for stronger alphas. However, the existing methods require extensive manual processing to generate effective alphas: On one hand, experts design formulas to capture diversified trading signals; On the other hand, experts need to specify the predefined stock groupings for customized stock prediction.

In this proposal, we propose data-driven methods to address the problem for alpha generation. Firstly, we propose a new class of alphas, and then devise a novel alpha mining framework based on AutoML, called AlphaEvolve, to generate the new alphas. Secondly, we propose a new framework, AlphaFlow, to empower the new class of alphas with learning capability. This framework emulates the alpha generation workflow in a hedge fund. Thirdly, we propose a new recurrent neural network, Hierarchical Expert-Gated Recurrent Unit (HE-GRU), to learn the data-driven groupings of stocks for accurate prediction. Lastly, we propose a new multi-modal framework to integrate diverse sources of information for fine-grained stock prediction. Extensive experiments on the real-life trading dataset show that the new alphas generated by our methods consistently yield over 100% returns while maintaining around 15% correlations. Additionally, our methods can identify useful stock groupings to support investment decisions. Therefore, our methods can provide intriguing quantitative investment opportunities for investors.